Your Internal Payment Account (IPA) is an effective tool for making outgoing and incoming international payments and currency conversions. It is particularly suitable for clients who receive payments in foreign currency from their business partners and also use those currencies to pay their liabilities.

Internal Payment Accounts

An effective tool for making outgoing and incoming international payments and currency conversions

54 000+ clients in 6 markets

More than 25 years on the market

More than 100 sales representatives

Simplicity and reliability

You carry out payments in compliance with all payment systems regulations, just as you would do with a bank account.

Fast transactions

Payments can be carried out in minutes.

Maximum level of safety

The maximum security of all transactions is a given!

Payment account in 17 currencies

You can open up to 17 IPAs for the most widely used currencies.

No hidden fees

Low or no fees for incoming and outgoing payments.

How to make payments using your IPA

1

- Add the standard banking information to your payment order.

- Sending payments to business partners you have already paid at least once from your IPA is much simpler – all it takes is one click of the mouse.

2

- After entering your payment, the funds are transferred from your IPA to the recipient bank account.

- When making payments from your IPA, the recipient will see the payment as received from AKCENTA CZ, however it will also contain your full identification information, so that your payee may correctly identify and accept your payment.

A preview of the payment received to the account of your business partner (appearance may differ depending on the bank):

1

- Add the standard banking information to your payment order.

- Sending payments to business partners you have already paid at least once from your IPA is much simpler – all it takes is one click of the mouse.

2

- After entering your payment, the funds are transferred from your IPA to the recipient bank account.

- When making payments from your IPA, the recipient will see the payment as received from AKCENTA CZ, however it will also contain your full identification information, so that your payee may correctly identify and accept your payment.

A preview of the payment received to the account of your business partner (appearance may differ depending on the bank):

How to receive payments via your IPA

We route your incoming payments effectively to make them as inexpensive as possible for your partner and as fast as possible for you. For this reason, it is critical that you proceed as follows:

1

- First complete a simple form to set up mutual banking. Send the completed form to us via email.

- You will need to complete the form for each business partner only once; your next incoming payment from the partner will be automatically credited.

2

- Make your business partners to send their payments to the AKCENTA CZ account.

- AKCENTA CZ will deposit the received payment to your IPA and will notify you via email and SMS with complete information about the payment received.

3

- You will see exactly who sent the payment in your IPA. The funds received will be available immediately for your use.

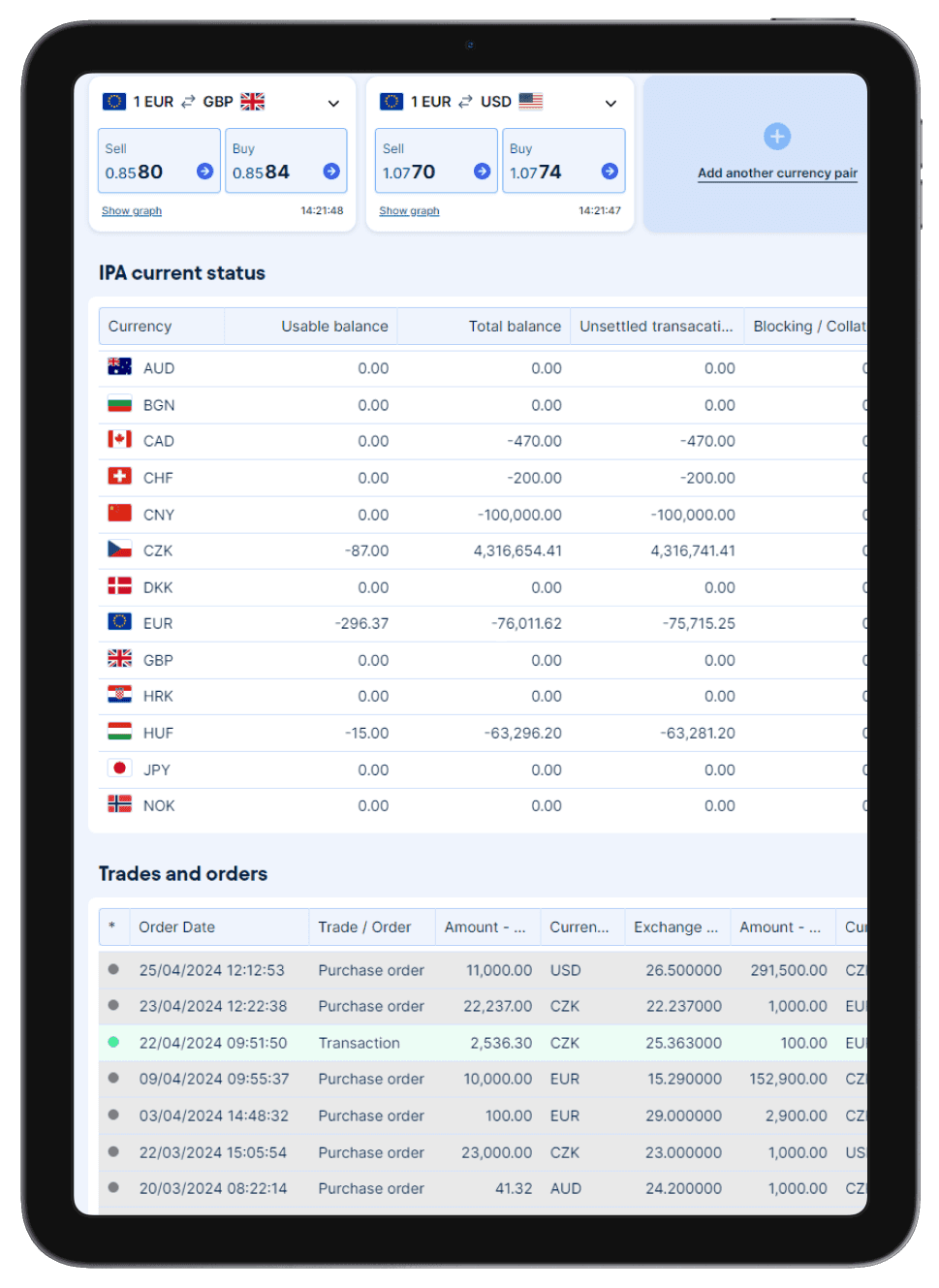

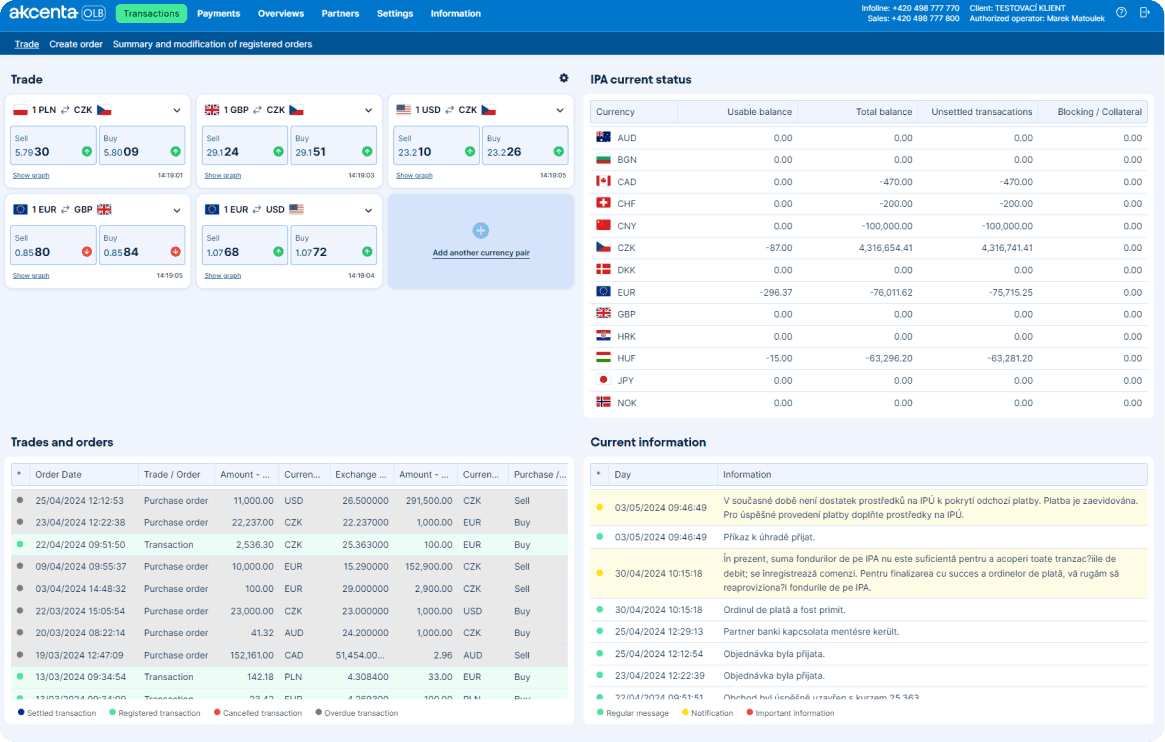

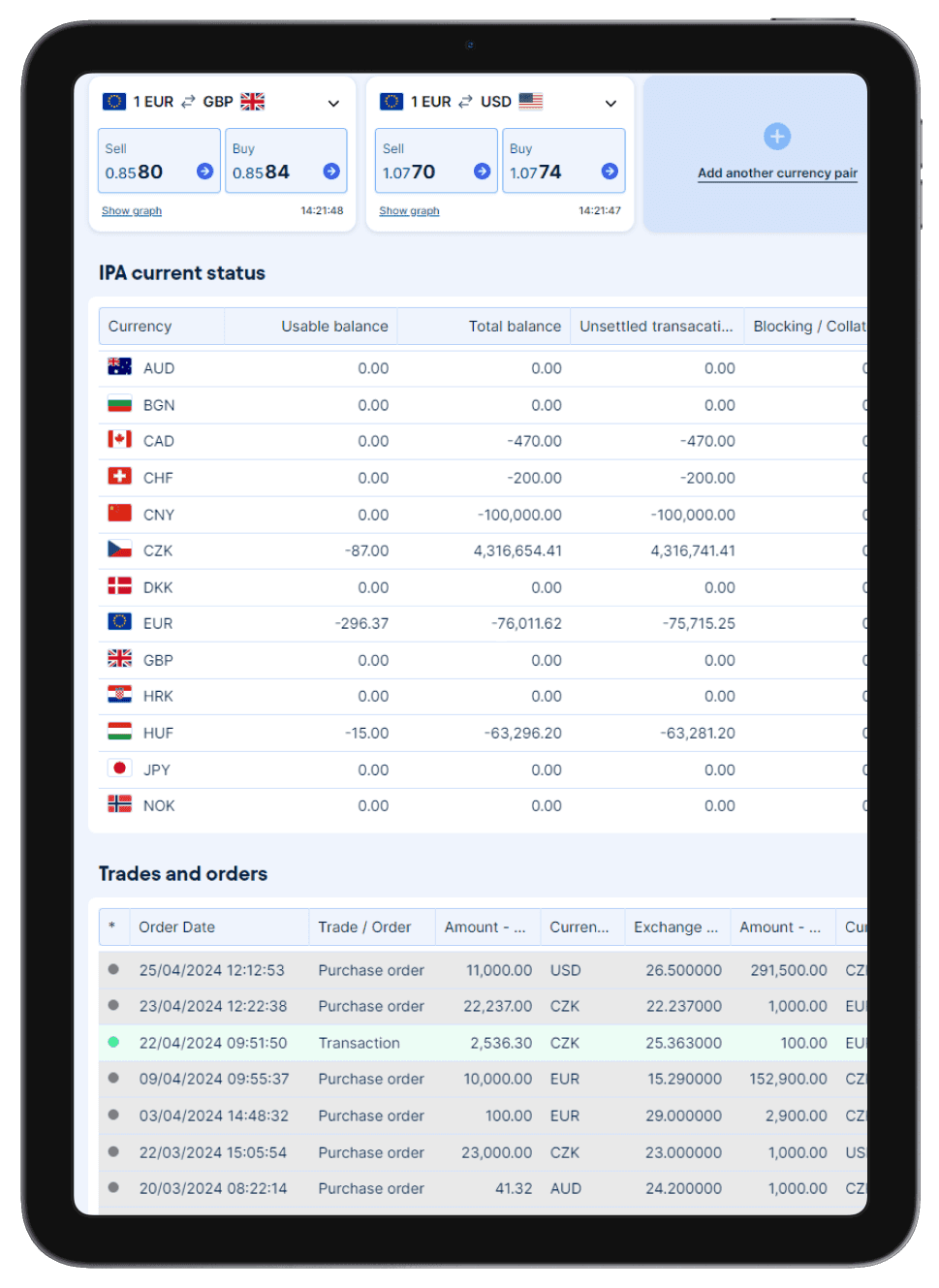

- You can check your balance at any time using the OLB internet application, where you can also enter all your payment orders.

1

- First complete a simple form to set up mutual banking. Send the completed form to us via email.

- You will need to complete the form for each business partner only once; your next incoming payment from the partner will be automatically credited.

2

- Make your business partners to send their payments to the AKCENTA CZ account.

- AKCENTA CZ will deposit the received payment to your IPA and will notify you via email and SMS with complete information about the payment received.

3

- You will see exactly who sent the payment in your IPA. The funds received will be available immediately for your use.

- You can check your balance at any time using the OLB internet application, where you can also enter all your payment orders.

Change of payment account

-

Change of the payment account is a process, which follows your decision to transfer either all or some of your payment activities from your existing payment service provider to a new payment service provider.

-

Request for the change of the payment account shall be filed through the Change of the Payment Account Request form, by which you ask the new provider to start the change of payment account process and to authorize it to carry out activities within the scope stated in the form.

-

In the case you are interested in this service, please contact us on our information line, where we will provide you with more detailed information.

If you have any questions, call our Infoline at +420 498 777 775, and we will be happy to inform you of your balance.

More about trading

Our sales representatives

You don't know what to do? Contact our sales representatives for more information.

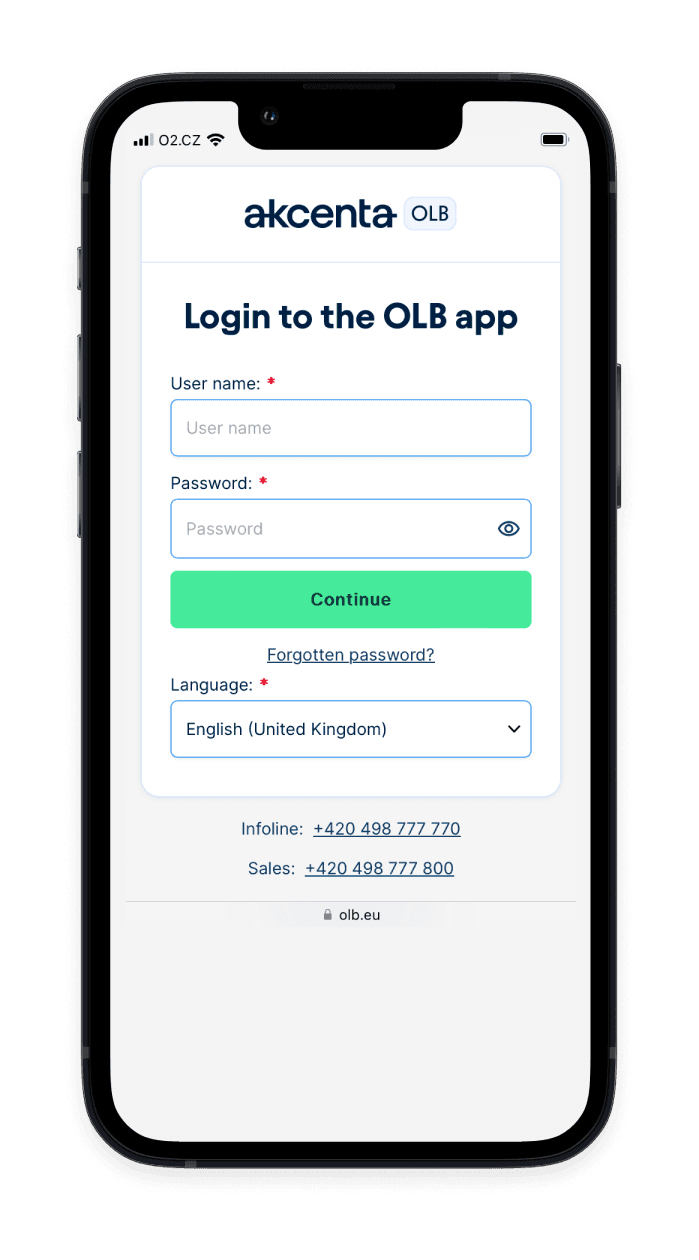

Online Broker

The new generation of the Online Broker (OLB) web platform offers a range of benefits.

General conditions and IPA operations

Akcenta has open accounts in the following countries and banks. Transferring money within these banks is free of charge or with minimal fees and can be done within minutes.

- We will set up your IPA automatically when you sign a Framework Agreement, which establishes the conditions and regulations under which the account is administered.

- Your IPA is administered by Akcenta and operations on any IPA are made only at the request of the client.

- IPA operations are recorded and the client receives regular electronic statements about the IPA.

- You can immediately determine your balance by signing in to the OLB internet application or by calling our Infoline at +420 498 777 770 and supplying your IPA password, which is assigned to you at the time of signing the Framework Agreement.

- Fees for individual transactions are listed in the pricelist.

The IPA serves only for the operations stated above and does not serve as a replacement for a current account with a bank or savings cooperative.

Akcenta bank accounts:

Czech Republic: Česká spořitelna, FIO Banka, Komerční banka, MONETA Money Bank, Raiffeisenbank

Slovakia: Tatra banka

Poland: Alior Bank SA, PEKAO SA, PKO BP, Santander Bank Polska SA, Bank Millennium SA, BNP Paribas Bank Polska SA, mBank SA

Hungary: OTP Bank, CIB Bank, MBH Bank, Raiffeisen Bank Zrt.

Romania: Banca Comercială Română S.A., BRD Groupe Societe Generale, Raiffeisen Bank S.A.

Akcenta partner banks

Our exchange rates

Currency

Buy

Sell

The exchange rates shown are informative in nature; for the most up-to-date rates, please call +420 498 777 800. You can find current exchange rates in our Online Broker anytime.